BLOG

13 Sep 2025

Market Summary - September 13, 2025

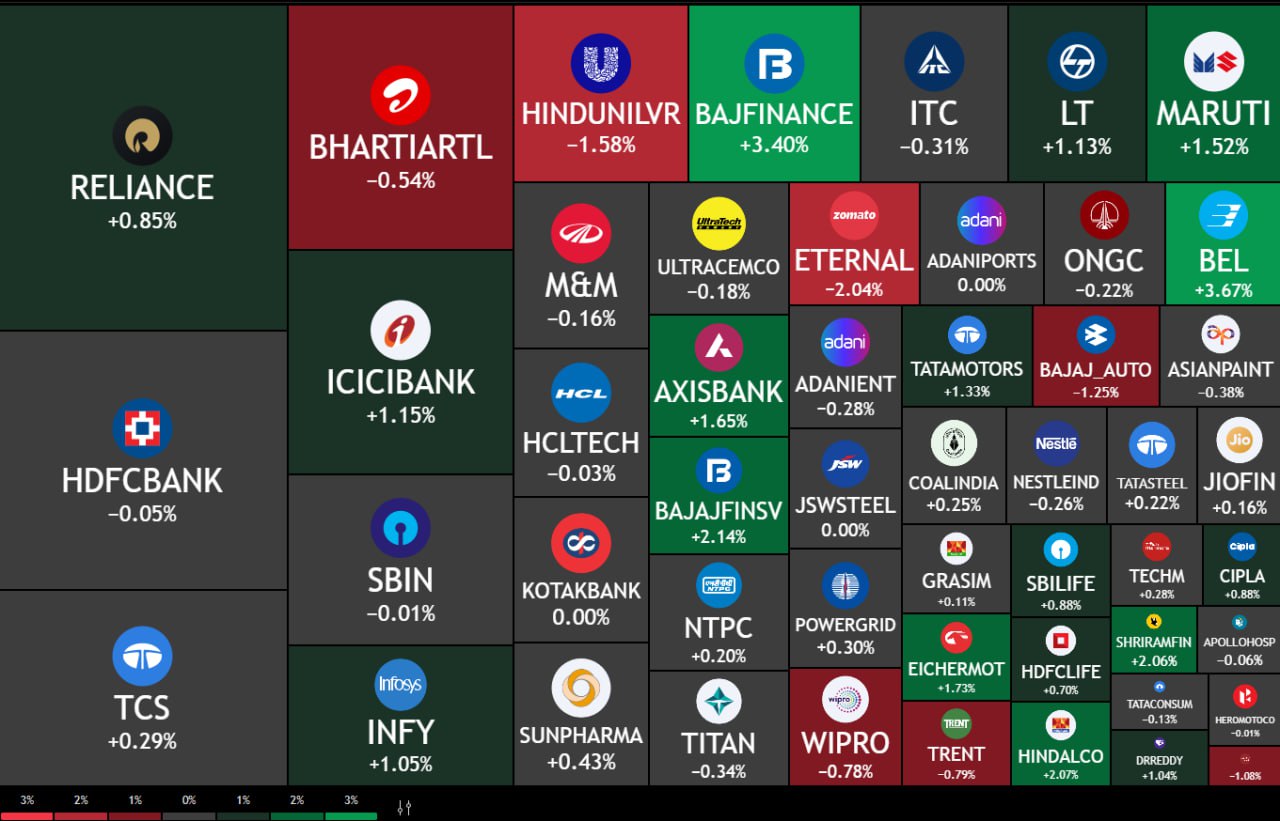

From today’s market heatmap, most heavyweight stocks showed steady performance, forming an overall bullish pattern. The financial sector was particularly impressive, with Bajaj Finance and Bajaj Finserv surging by 3.40% and 2.14% respectively, leading the index upward. ICICI Bank and Axis Bank also rose more than 1%, making the banking and financial services sectors the main driving forces in the market. Among tech stocks, Infosys rose by 1.05%, and TCS closed slightly in the green, indicating that funds still have interest in flowing into the IT sector. The auto sector also performed strongly, with Maruti and Tata Motors both gaining over 1%, contributing significant momentum to the index.

On the other hand, consumer goods and some defensive sectors came under pressure. Hindustan Unilever fell by 1.58%, and Asian Paints and Nestle also showed slight weakness, indicating short term capital outflows from the consumer segment. Other underperformers included Eicher Motors, Dr. Reddy’s, and Bajaj Auto, which dragged down parts of the index. However, the overall market remains in an upward trend. Financials, autos, and some cyclical sectors are supporting the index, and if a breakout above the previous high is achieved on strong volume in the short term, the rebound trend is likely to continue.

Defensive sectors being under pressure is actually a good sign, it shows that funds are more willing to bet on offensive directions, and the trend rebound may last longer.

Today the overall market sentiment is still on the optimistic side, not many stocks closed in the red, if there is no gap-down opening on Monday, it is worth trying to go long again.

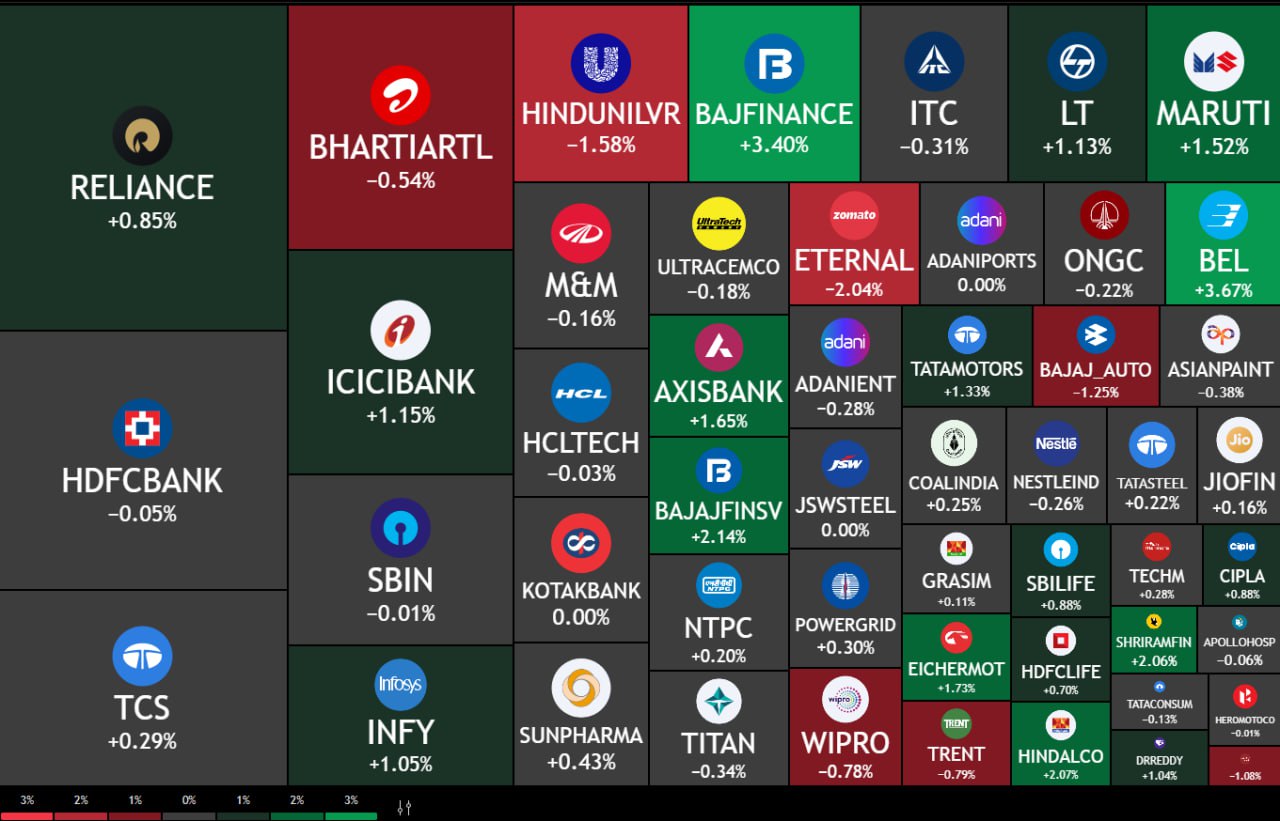

On the other hand, consumer goods and some defensive sectors came under pressure. Hindustan Unilever fell by 1.58%, and Asian Paints and Nestle also showed slight weakness, indicating short term capital outflows from the consumer segment. Other underperformers included Eicher Motors, Dr. Reddy’s, and Bajaj Auto, which dragged down parts of the index. However, the overall market remains in an upward trend. Financials, autos, and some cyclical sectors are supporting the index, and if a breakout above the previous high is achieved on strong volume in the short term, the rebound trend is likely to continue.

Defensive sectors being under pressure is actually a good sign, it shows that funds are more willing to bet on offensive directions, and the trend rebound may last longer.

Today the overall market sentiment is still on the optimistic side, not many stocks closed in the red, if there is no gap-down opening on Monday, it is worth trying to go long again.