BLOG

11 Sep 2025

Market Summary - September 11, 2025

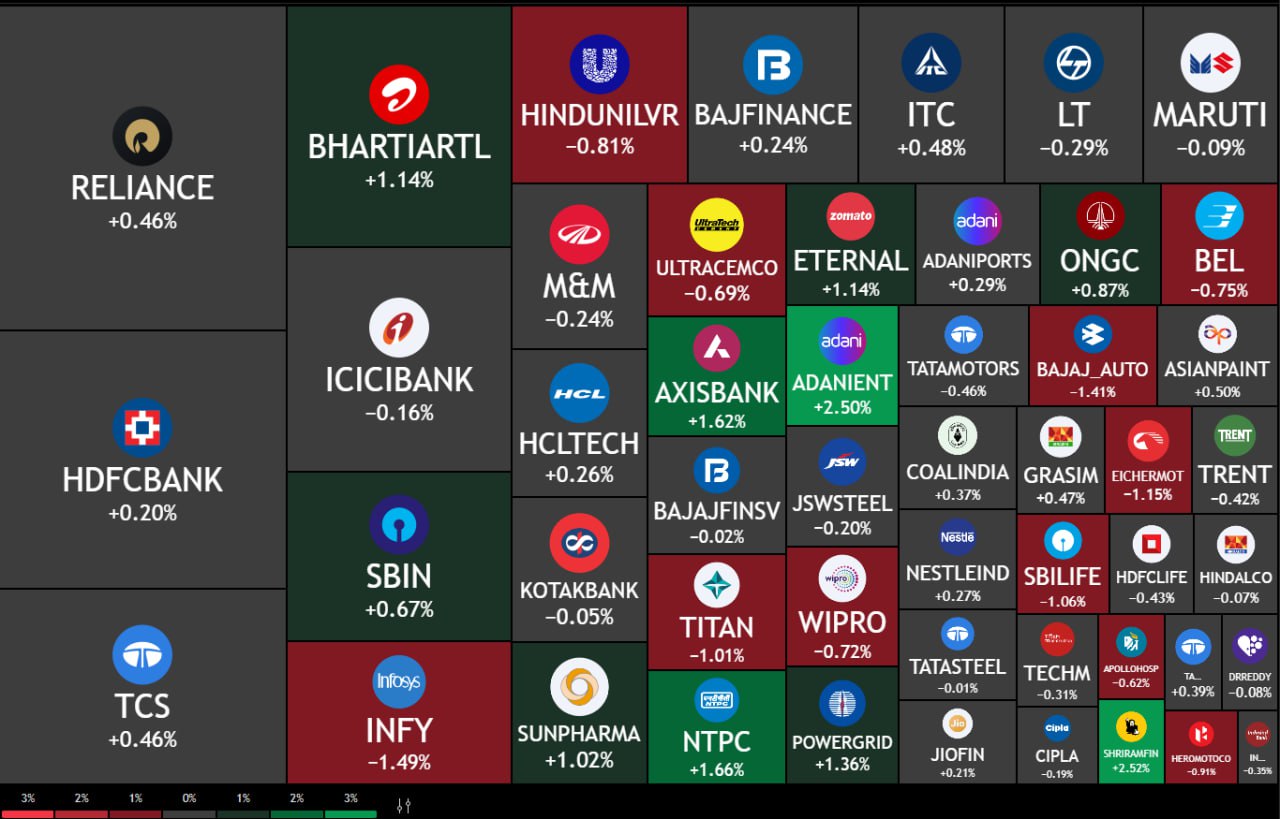

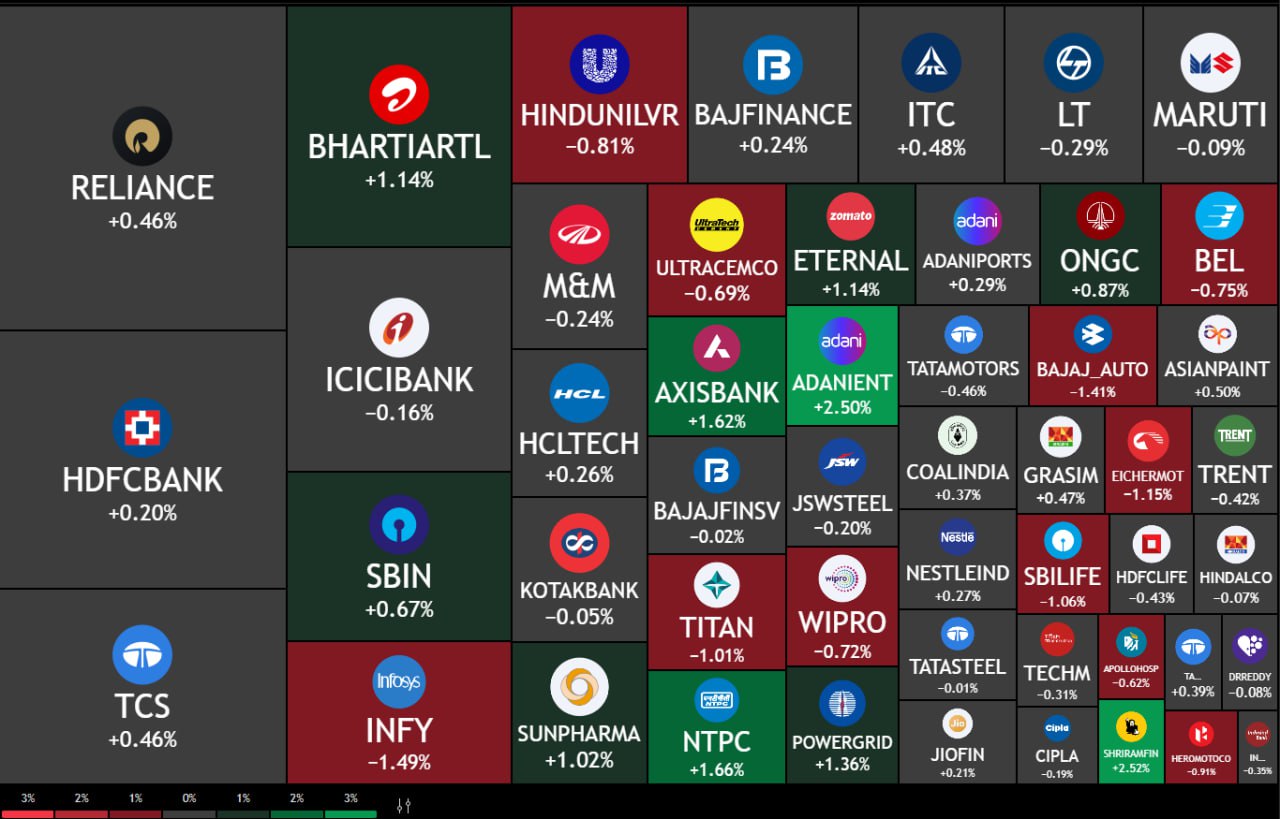

From today's market heatmap, the overall sector performance shows a clear divergence pattern. Banking and financial services sectors performed strongly, with AXISBANK rising by 1.62%, NTPC and POWERGRID increasing by 1.66% and 1.36% respectively, providing solid support to the index; ADANIENT stood out the most with a gain of 2.50%, becoming the highlight of the market. Defensive sectors like SUNPHARMA and COALINDIA also recorded steady gains, indicating partial fund flow into low volatility assets, with the overall market sentiment leaning towards cautious optimism.

On the other hand, technology and consumer stocks came under pressure, with Infosys dropping by 1.49%, and Bajaj Auto, Titan, Eicher Motors, and Wipro all recording declines of over 0.7%, putting some drag on the index. Consumer blue chips HINDUNILVR and ULTRACEMCO dropped by 0.81% and 0.69% respectively, showing signs of capital outflow from high valuation blue chip stocks. Overall, the market remains in a phase of structural rotation, with heavyweight financial and power stocks providing support. In the short term, if the bulls sustain momentum, the index is still expected to maintain a range bound upward trend.

On the other hand, technology and consumer stocks came under pressure, with Infosys dropping by 1.49%, and Bajaj Auto, Titan, Eicher Motors, and Wipro all recording declines of over 0.7%, putting some drag on the index. Consumer blue chips HINDUNILVR and ULTRACEMCO dropped by 0.81% and 0.69% respectively, showing signs of capital outflow from high valuation blue chip stocks. Overall, the market remains in a phase of structural rotation, with heavyweight financial and power stocks providing support. In the short term, if the bulls sustain momentum, the index is still expected to maintain a range bound upward trend.