BLOG

14 Sep 2025

Why does everyone actively participate in IPOs?

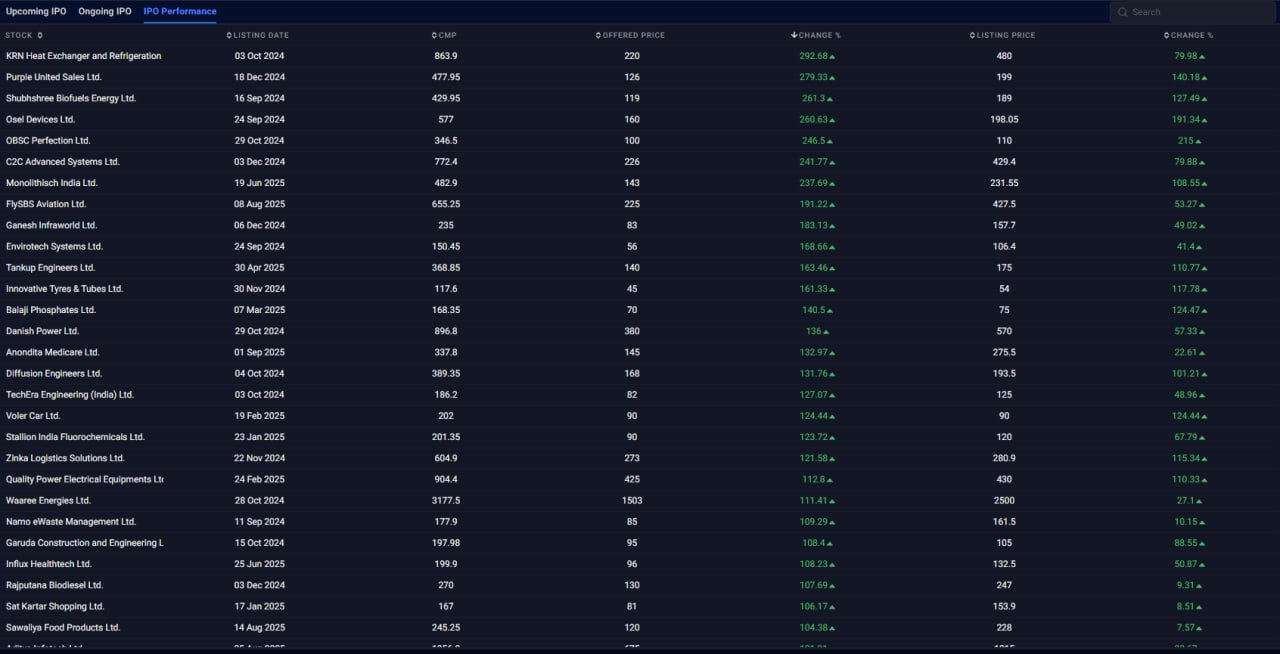

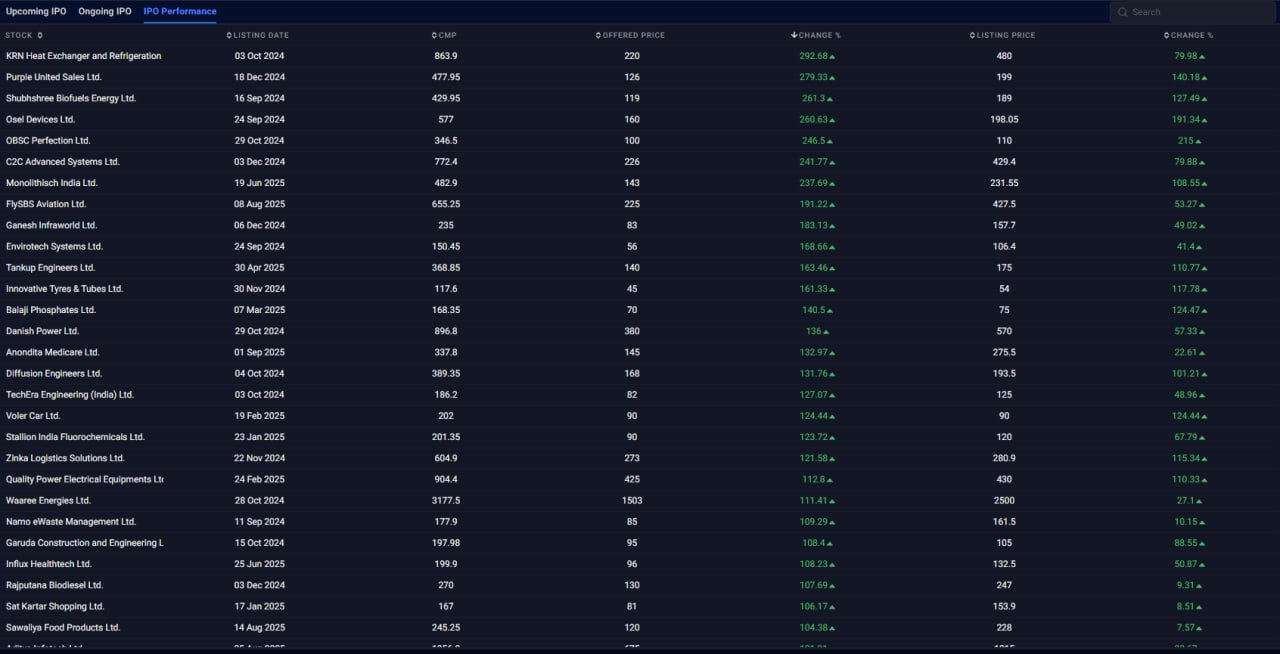

As clearly shown in the IPO historical performance table above, most quality IPOs see significant gains after listing, many companies have doubled or even surged over 200% within just a few months. This proves that the primary market gives us the opportunity to invest in high quality companies at relatively low prices, allowing our capital to grow faster.

As long as we select IPOs with strong fundamentals and reasonable valuations, even short-term fluctuations still leave a high probability of achieving desirable returns. In the medium to long term, there’s even greater potential to share in the ongoing growth of these companies. Therefore, the IPOs I recommend can be applied for in a timely manner to seize these rare opportunities in the primary market, this not only improves capital efficiency but also balances stability with returns, helping us achieve excess gains in the market.

As long as we select IPOs with strong fundamentals and reasonable valuations, even short-term fluctuations still leave a high probability of achieving desirable returns. In the medium to long term, there’s even greater potential to share in the ongoing growth of these companies. Therefore, the IPOs I recommend can be applied for in a timely manner to seize these rare opportunities in the primary market, this not only improves capital efficiency but also balances stability with returns, helping us achieve excess gains in the market.